The Three Horizons of Growth: Simple Model for a Complex Portfolio

Here’s a paradox that destroys most companies. The management practices that make you profitable today are often the exact systems that blind you to tomorrow.

Kodak invented the digital camera in 1975. They owned the patent. They saw the future coming. But their film business was too profitable to risk, so they buried the invention.

Decades later, Kodak filed for Chapter 11 bankruptcy protection in January 2012.

This isn’t about stupidity. It reflects the classic Innovator’s Dilemma faced by incumbents. When your core business is printing money, every new idea looks small, risky, and inefficient.

In the late 1990s, McKinsey consultants articulated the Three Horizons framework in The Alchemy of Growth as a way to think about balancing today’s business with future sources of growth.

They wanted to find the “genetic code” of long-term success. What they discovered became the Three Horizons of Growth framework.

This isn’t just another planning tool. It’s a survival manual. It shows you how to manage today’s profits while building tomorrow’s business and exploring the future, all at the same time.

Most companies fail because they try to manage everything with the same rules.

What the Three Horizons Actually Mean (And Why Time Isn’t the Point)

The biggest mistake people make with this framework is thinking it’s about time. Horizon 1 is this year, Horizon 2 is three years out, Horizon 3 is ten years away. Wrong.

The horizons are about uncertainty, not calendars. They’re about how you manage different types of business at different stages of development.

Here’s how the three horizons compare:

| Feature | Horizon 1 | Horizon 2 | Horizon 3 |

|---|---|---|---|

| Focus | Defend and extend | Build and scale | Learn and discover |

| Metrics | Profit, ROI, efficiency | Revenue growth, market share | Hypotheses validated, learning velocity |

| Mindset | Managerial | Entrepreneurial | Visionary |

| Risk | Avoid operational risk | Manage scaling risk | Embrace uncertainty |

| Cash Flow | Positive and strong | Negative (high burn) | Negative (pure investment) |

| Success Means | Hit the budget | Gain traction fast | Reduce risk per dollar spent |

Horizon 1: Your Cash Cow (Defend and Extend)

This is your core business. It pays the bills today. It’s what people think of when they hear your company name.

The focus here is operational excellence. Cut costs, improve margins, optimize the supply chain. Squeeze every drop of efficiency from the current model.

Success means hitting your numbers and avoiding mistakes. The mindset is managerial and the metrics are profit, ROI, and efficiency.

The trap is letting this thinking dominate everything. When you judge every idea with Horizon 1 standards, you kill the future.

Horizon 2: The Bridge (Build and Scale)

Horizon 2 is the middle ground. These are emerging opportunities that show traction but aren’t fully profitable yet.

Think aggressive customer acquisition, geographic expansion, or new product lines. You’re building fast and burning cash to grab market share.

Here’s the critical distinction:

H2 minus versus H2 plus. H2 minus innovations just extend the old system’s life. They’re trying to fix the past. H2 plus innovations actually build the bridge to a new future.

Amazon Prime is a perfect H2 example.

When it launched, shipping costs exceeded subscription revenue. It was a massive financial risk. But it locked in customers and transformed Amazon from a store into a lifestyle utility.

Horizon 3: Your Options for the Future (Learn and Discover)

Horizon 3 isn’t a business yet. It’s an option. These are research projects, pilot programs, and experiments.

The goal isn’t profit. It’s validated learning. You’re trying to reduce uncertainty about the future, not generate revenue today.

Most H3 projects will fail. That’s the point. Fail fast and cheap to find the few ideas worth scaling to H2.

Amazon Web Services started as an H3 experiment. Amazon was a retailer. Building cloud infrastructure for other companies made no sense.

But Jeff Bezos let it grow independently. Today, AWS contributes a disproportionate share of Amazon’s operating income relative to its revenue.

The Fatal Mistake: Managing All Three the Same Way

Asking for ROI on a Horizon 3 project is like judging a baby’s value with their current salary. But companies do it constantly, and it kills their future.

Here’s what happens.

An executive asks, “What’s the return on this H3 experiment?” The answer is zero or negative because there’s no revenue yet. Project killed. Future murdered.

The organization has an immune system designed to protect Horizon 1. When something new appears that’s small, risky, and inefficient, the antibodies attack.

Finance rejects it because it doesn’t fit the budget template. Legal flags the risk. Operations says it violates standards.

Linear thinking makes it worse.

Leaders say, “First we fix the core, then we grow, then we innovate.” This sequence guarantees obsolescence. The time your core shows cracks, it’s too late to start exploring.

The solution is concurrent management. Run all three horizons simultaneously. H1 pays today’s bills while H2 secures tomorrow’s market share and H3 identifies next decade’s survival strategy.

You need different metrics for different horizons. H1 gets judged on profit. H2 gets judged on growth rate. H3 gets judged on return on learning.

Return on learning asks:

Did we reduce uncertainty? If you spend $50,000 on a prototype and discover customers hate it, traditional accounting calls that a $50,000 loss.

Innovation accounting calls it a success. You just avoided wasting $5 million on a full product launch nobody wanted.

The 70-20-10 Rule (And When to Break It)

A commonly cited rule of thumb in innovation portfolio management is a 70/20/10 split across core, adjacent, and transformational initiatives

Seven out of ten dollars keep the engine running. Two dollars scale emerging ventures. One dollar funds pure experimentation.

This isn’t universal law. It’s a starting point. The right ratio depends on your situation.

- Tech startups might look more like 50/40/10. They need aggressive growth in H2 to survive. Legacy utilities might look like 90/9/1. Their core business requires massive capital and generates stable cash.

- Crisis mode changes everything. A newspaper in 2005 facing internet disruption couldn’t stick with 70/20/10. They needed something like 40/40/20 to survive the collapse of their core business.

Here’s how the ratio shifts based on your situation:

| Company Phase | H1 (Core) | H2 (Growth) | H3 (Explore) | Example |

|---|---|---|---|---|

| Mature / Stable | 80–90% | 10–15% | 1–5% | Utilities, construction |

| Growth / Tech | 60–70% | 20–30% | 10% | Software, pharma |

| Disrupted / Crisis | 40–50% | 30–40% | 10–20% | Media (2010s), auto (2020s) |

Here’s the tricky part. While H3 gets only 10% of the budget, it often needs 30-40% of the CEO’s attention.

H3 projects are fragile. They threaten the status quo. They violate company policies. Without active executive protection, the H1 immune system kills them.

The ratio of dollars (70/20/10) should not match the ratio of executive time. The CEO must shield H3 experiments from H1 managers trying to cut them to meet quarterly targets.

How to Actually Implement This (Without Another Failed Workshop)

Most frameworks die in PowerPoint. They become another consultant deck gathering dust. Here’s how to make the Three Horizons real.

Start With the Honest Conversation

Map your current portfolio. Be brutally honest. What percentage of your resources actually goes to each horizon?

Most leadership teams discover something like this: 90% to H1, 8% to H2, 2% to H3. Some have literally nothing in H3 except vague buzzwords like “AI strategy” with no actual projects.

This visual imbalance is your wake-up call. An empty H3 pipeline means you have no options when the market shifts. Ask your team to identify baggage versus luggage:

- Baggage is what you need to leave behind: outdated processes, inefficient systems, dying products.

- Luggage is what you want to carry forward: brand trust, customer relationships, core capabilities.

Then ask the killer question: “If a startup launched today specifically to destroy our company, what would they build?” That’s probably your missing H3.

Set Up Different Metrics for Different Horizons

Stop asking for ROI on everything. Create an innovation accounting system separate from traditional P&L.

Horizon 1 metrics: Operating profit, gross margin, efficiency ratios, defect rates. Did we hit the budget?

Horizon 2 metrics: Revenue growth rate, customer acquisition cost, monthly recurring revenue, market share gains. Are we growing fast enough?

Horizon 3 metrics: Learning velocity, hypotheses validated, risk reduced per dollar spent, problem-solution fit scores. Did we learn enough to continue or stop?

This requires discipline.

When an H3 team presents results, don’t ask about revenue. Ask about validated learning. What did you discover? What risks did you eliminate?

Protect H3 From H1’s Immune System

Here’s the uncomfortable truth: Without executive air cover, your H1 managers will kill H3 projects to make their quarterly numbers.

It’s not malicious. It’s rational. They’re judged on hitting targets. An H3 experiment that “wastes” budget threatens their bonus.

Establish a Growth Board separate from your executive committee. Meet quarterly. Their mandate is portfolio balance, not operations.

The agenda is simple:

- Review the resource split. Are we maintaining our target allocation?

- Make stage-gate decisions on H3 experiments. Kill, pivot, persevere, or graduate to H2.

- Protect H3 from H1 poaching. If H1 managers are raiding H3 budgets, intervene.

Use different incentive structures for H3 leaders. Consider phantom equity for internal entrepreneurs.

Let them earn a percentage of the value they create if the experiment succeeds. This gives them skin in the game without requiring them to leave the company.

Create “translator” roles. These are people who can speak both H1 language (efficiency, profit) and H3 language (learning, options). They bridge the cultural gap.

Start small. Pick one H3 experiment this quarter. Give it protection. Fund it properly. Measure it differently. Show the organization it can survive and even thrive.

The Ambidextrous Imperative

The real enemy of your future isn’t external disruption. It’s internal efficiency that optimizes you into obsolescence.

The solution is a paradox: maintain the old while building the new, creating multiple options for when the market shifts.

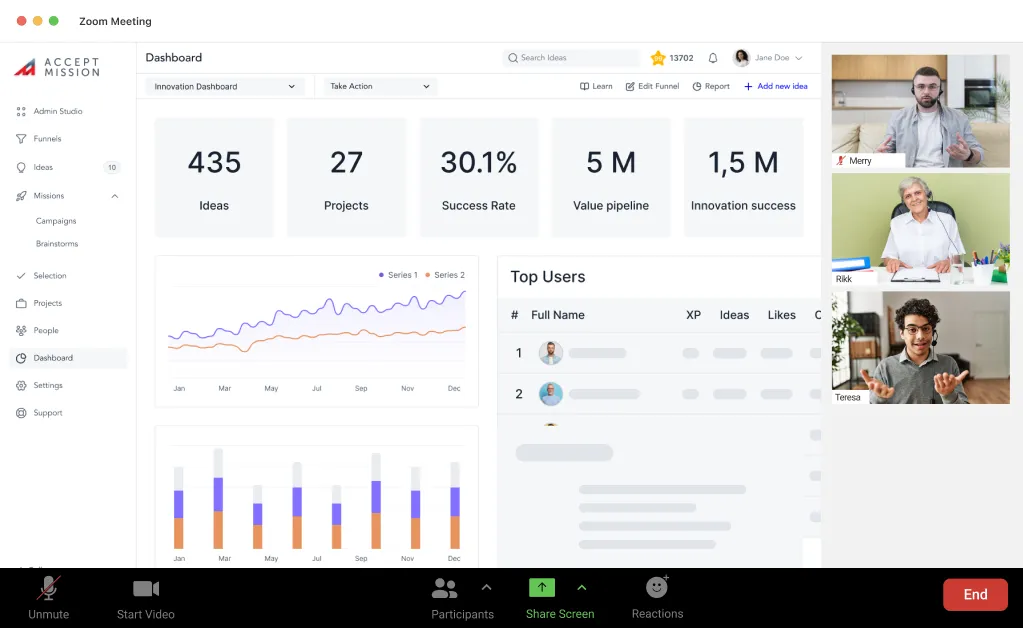

Accept Mission creates separate funnels for each horizon, so H3 experiments don’t get killed with H1 standards.

Here’s how the platform supports ambidextrous management:

- Custom funnels with stage-gates – Build different workflows for H1 optimization, H2 scaling, and H3 exploration

- AI-powered scoring criteria – Set different evaluation metrics for each horizon so ideas get judged appropriately

- Portfolio visualization – See your entire innovation portfolio at a glance and spot resource allocation gaps instantly

- Idea campaigns – Launch targeted missions to collect H3 experiments, H2 growth ideas, or H1 improvements separately

- Project management integration – Graduate ideas from H3 to H2 to H1 with full tracking and accountability

- Real-time dashboards – Monitor the health of each horizon and identify when your future pipeline is empty

Your Growth Board gets live data showing where resources actually go versus where they should go. No more spreadsheets trying to manage three different types of innovation with the same approval process.

Ready to stop hoping for the future and start building it?

Book a demo with Accept Mission today and see how leading organizations manage their innovation portfolio across all three horizons.

We’ll show you exactly how to set up separate funnels, configure horizon-specific metrics, and protect your H3 experiments from your H1 immune system.