How to Build a Business Case for Your Next “Big Bet” Innovation Project

Your finance team wants certainty. They want five-year projections, detailed ROI calculations, and predictable cash flows.

But you can’t use spreadsheets designed for factory upgrades to justify projects that create entirely new markets.

This creates the “theater of innovation.”

Teams fabricate certainty to satisfy finance departments, inventing hockey-stick growth charts that everyone knows are fiction.

But there’s a better way.

The best business cases for big innovation projects don’t pretend to predict the future. They offer a disciplined process for navigating uncertainty.

What Actually Qualifies as a “Big Bet” (And Why)

The distinction matters because different types of projects need different management approaches.

Use the wrong framework, and you’ll either over-engineer a simple improvement or under-prepare for a genuine moonshot.

The Horizon Framework: Know Which Game You’re Playing

McKinsey’s Three Horizons model gives you a simple way to classify your project. Each horizon operates on different timelines and requires different metrics.

Horizon 1 is your core business. These projects optimize what you already have.

Think efficiency improvements, feature additions, or process upgrades. They generate cash flow today and the results are predictable.

Horizon 2 extends your capabilities to new markets or customer segments.

These projects typically take 2-5 years to mature. You’re using existing strengths in new ways.

Horizon 3 creates future value through entirely new capabilities. These are 5-12 year plays. You’re building something that doesn’t exist yet.

Here’s the critical mistake most organizations make:

They evaluate Horizon 3 projects using Horizon 1 metrics. They ask for Year 1 EBITDA on a project that won’t generate revenue for three years.

Your business case must explicitly state which horizon you’re in. If you’re proposing a horizon 3 initiative, say it clearly:

“This is a long-term growth project. We will not evaluate it based on short-term profitability, but on learning velocity and option value.”

That single statement changes the entire conversation.

Building the Financial Case

Traditional financial models assume you can predict the future. For innovation projects, that assumption is dangerous.

The reverse income statement replaces prediction with discovery.

It shifts conversations from “I don’t believe your forecast” to “Do we believe these assumptions are testable?”

The Reverse Income Statement Approach

Standard financial planning starts with revenue projections. You estimate sales, subtract costs, and hope for profit.

Reverse income statement planning flips this logic.

You start with the profit required to justify the investment, then calculate backward to determine what must be true.

Here’s the process:

Step 1: Define the required profit. For a big bet to “move the needle” at your company, it might need to generate $50 million in annual profit by Year 5.

Step 2: Calculate allowable costs. If you need $50M profit and project $100M revenue, your total costs cannot exceed $50M.

Step 3: Determine necessary velocity. Use this formula:

Required Units = (Profit Goal + Fixed Costs) / (Price – Variable Cost)

Step 4: Run the sanity check.

If the calculation says you need to sell 100,000 units, ask: Does that market even exist? Can we reach that many buyers within our allowable acquisition cost?

Let’s work through a real example. Imagine you’re proposing a new B2B software tool.

- Required profit in year 5: $20 million

- Expected price per license: $5,000 annually

- Variable cost per customer: $1,000 (support, hosting)

- Fixed costs: $15 million (development, overhead)

The calculation: (20M + 15M) / (5,000 – 1,000) = 8,750 customers

Now the conversation changes. Instead of debating revenue forecasts, you’re discussing:

- Can we acquire 8,750 enterprise customers?

- What would acquisition cost need to be?

- Does our addressable market contain that many qualified prospects?

This approach isolates the critical variables.

You know exactly what needs to be true for success. The business case becomes a set of testable hypotheses instead of hopeful predictions.

The Amazon “Working Backwards” Method

Amazon has a rule.

Before any team requests development budget, they must write the future press release announcing the product’s launch.

This practice forces clarity. If you can’t articulate customer value in plain language, you don’t understand the problem well enough to build a solution.

The press release is written as if the product launched today. It should make someone reading it think, “I want that.”

Here are the required elements:

- Heading: A customer-centric product name (no internal code names or jargon)

- Subheading: One sentence summarizing the benefit and target market

- Problem: Why the current situation is painful for customers

- Solution: How your product solves it (focus on experience, not technology)

- Leader quote: Your executive sponsor explaining why this matters

- Call to action: How customers can get it

Here’s the brutal truth Amazon learned: If the press release isn’t exciting to read, the product isn’t worth building.

This simple filter saves millions in wasted R&D. It’s a “fail fast” mechanism that operates at the concept stage, before you’ve written a single line of code.

Try drafting one for your big bet. If you struggle to make it compelling, you might not have a strong enough value proposition.

That’s valuable information to discover now, not three years and $10 million later.

Your business case should include this press release prominently. It demonstrates you understand customer value, not just technical features.

It also provides a clear vision that helps stakeholders see what success looks like in concrete terms.

The “Tackle the Monkey First” Principle (For Risks)

Most teams bury the hard problems under easier work. They build infrastructure, design logos, and create websites.

Those are tangible progress that avoids the difficult questions. This wastes resources and delays the moment of truth.

Mapping Your Assumptions with DVF Framework

Categorize your risks across three dimensions:

Desirability (Human): Do customers actually want this? Is the problem real and painful enough to drive behavior change?

Example assumption: “Drivers are willing to trust an autonomous vehicle in snow conditions.”

Viability (Business): Can we build a sustainable business model around this solution?

Example assumption: “The cost of LIDAR sensors will drop enough to make our target price point profitable.”

Feasibility (Technical): Can we actually build this with our capabilities and timeline?

Example assumption: “Our AI models can process visual data with 99.9% accuracy in real-world conditions.”

Create an assumption map using a simple 2×2 matrix:

| Evidence Level | High Importance | Low Importance |

|---|---|---|

| Low Evidence | Leap of Faith (Test first) | Interesting questions (Test later) |

| High Evidence | Known constraints (Manage actively) | Background facts (Monitor only) |

Your “leap of faith” assumptions sit in the top-left quadrant. These are high importance (if false, the business fails) and low evidence (you have no data supporting them yet).

Your business case must explicitly state that initial funding targets only these assumptions.

You’re not building the product yet. You’re buying information to move critical unknowns from “low evidence” to “high evidence.”

This is the core of the “buying information” strategy. Each funding tranche purchases answers to specific questions.

The Google X “Monkey First” Approach

Google X has a memorable metaphor:

If your goal is to teach a monkey to recite Shakespeare while standing on a pedestal, don’t start with the pedestal.

Most innovation teams do exactly that. They create brand guidelines, design interfaces, and establish governance committees.

All the easy stuff that feels productive but doesn’t test whether the core idea works.

Identify your “monkey.” That’s the hardest, most intractable challenge. Then tackle it first.

For example:

- Marketplace platform: Can we achieve supply-side liquidity before running out of capital?

- Medical device: Can we achieve required accuracy with a form factor customers will actually use?

- B2B software: Will customers change their workflow to adopt this tool?

Structure your funding request around solving the monkey first. Request just enough to validate your core assumption:

“We’re requesting $500,000 to validate our core technical assumption over six months.”

Define explicit kill criteria:

“If pilot customers don’t use the core feature at least 3 times per week, we will not proceed.”

This demonstrates fiscal responsibility and builds credibility with executives.

One Google X team lead put it this way:

“We celebrate when we kill a project in three months instead of three years. We didn’t fail. We succeeded at failing fast.”

Selling the Process, Not Predicting the Future

The most persuasive business cases don’t predict the future, but instead offer a rigorous methodology for rapid learning to navigate uncertainty.

Your business case makes this argument: “We don’t know if this will work, but we know how to find out.”

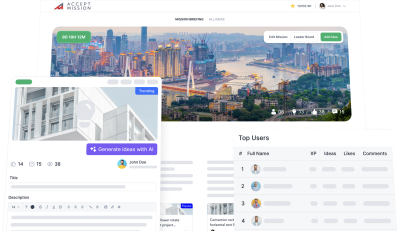

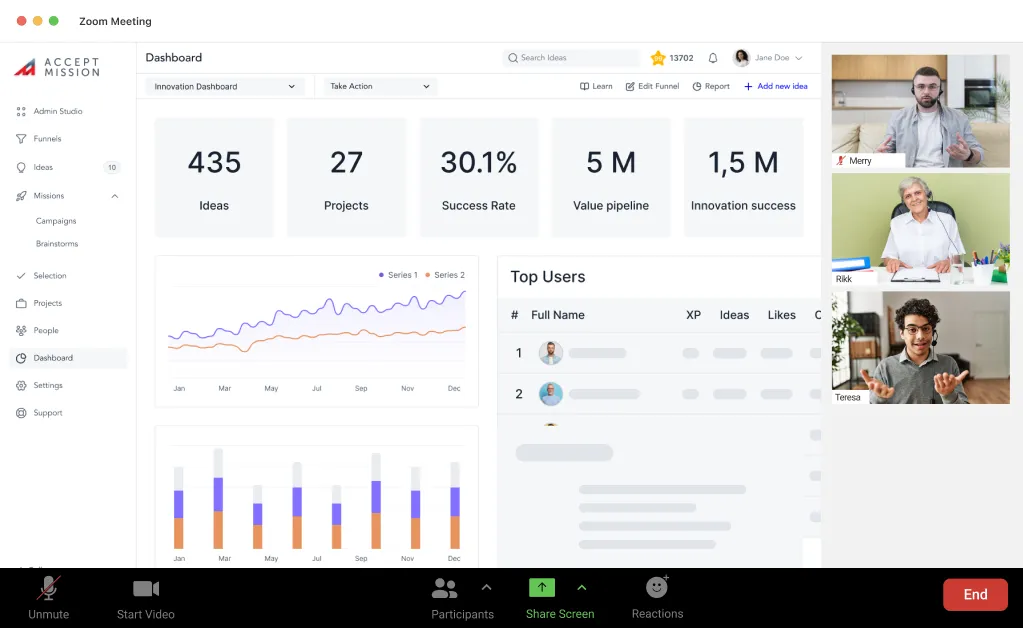

Platforms like Accept Mission turn this framework into a measurable innovation process, operationalizing your business case.

The platform helps you execute the frameworks in this article through specific capabilities:

- Stage-gate funnels with customizable gates that map directly to your DVF assumptions and kill criteria

- Assumption tracking that moves critical hypotheses from “low evidence” to “high evidence” through structured validation campaigns

- AI-powered scoring to evaluate ideas against your custom criteria (desirability, viability, feasibility)

- Real-time dashboards showing which projects passed gates, which were killed early, and what was learned

- Reverse Income Statement modeling through integrated business case templates that calculate required velocity

- Metered funding workflows that release budget only when checkpoint criteria are validated

The difference between innovation theater and actual innovation is measurement.

A platform that tracks innovation progress with evidence transforms it from a gamble into a managed investment for finance departments.

Ready to build business cases that actually get funded?

Book a demo with Accept Mission to learn how organizations systematically validate assumptions and make evidence-based decisions for big bet proposals.